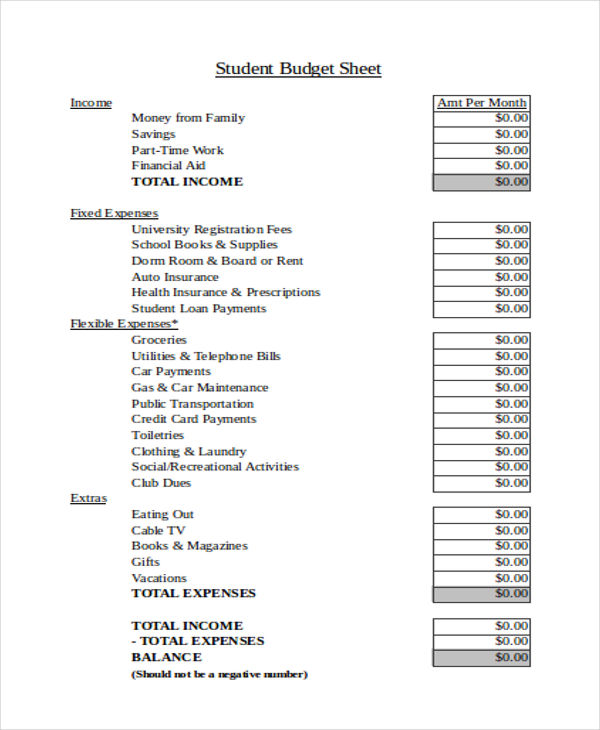

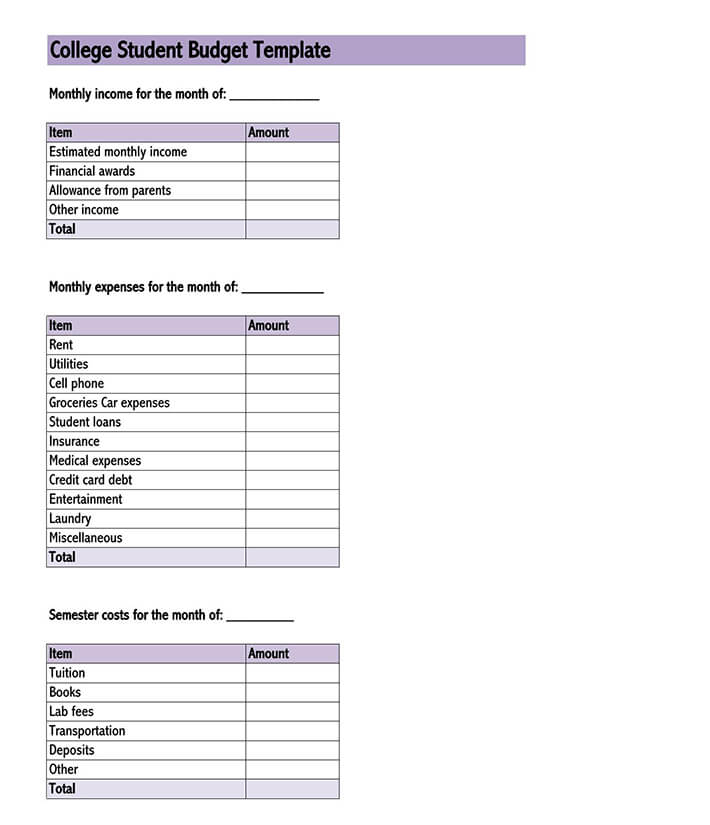

Then, see how much you have left for discretionary spending, such as entertainment, clothes, charitable giving, etc. Your goal is to match your income against your scheduled expenses to help ensure you’ll be able to cover the essential ones like tuition, books, transportation, and housing. Student loans pay for 13%, and the remaining costs are covered by student savings and income, parent borrowing, and gifts from relatives.

Next up, scholarships and grants pay for 25% of students’ costs. But if you want to know generally how your situation compares to others, here are some broad averages: The largest portion of college costs (44%) are paid for with parents’ income and savings. The combination of income sources will be unique for each student. That provides your baseline as you move to the next step. That way, you can accurately break down your total income into something more manageable - like a monthly budget, for instance. It will likely be a combination of all three, because for each source of income, you’ll want to note when you’ll be paid and how much the payment will be. The first step in creating a budget is identifying all of your income sources and deciding if you want to track your budget weekly, monthly, or quarterly. Here are seven steps to building a budget as a student. 2Īs you begin your financial journey (and even when you’re a seasoned pro), regularly paying attention to your spending habits and putting together a budget that works for you can help you stay on top of your income versus your expenses - and allow you to splurge on something besides ramen from time to time. 1 And despite the uncertainty caused by the pandemic, back-to-school spending by college students continued to rise from year to year. It’s true that being a college student can be expensive, with the average student spending close to $53,000 on rent, transportation, and personal expenses throughout their four-year college career - which is 12% more than the amount they spend on academic needs like tuition and books. You’ve probably heard the stereotype that college students live exclusively off ramen to maintain notoriously tight budgets, but that doesn’t have to be the case.

0 kommentar(er)

0 kommentar(er)